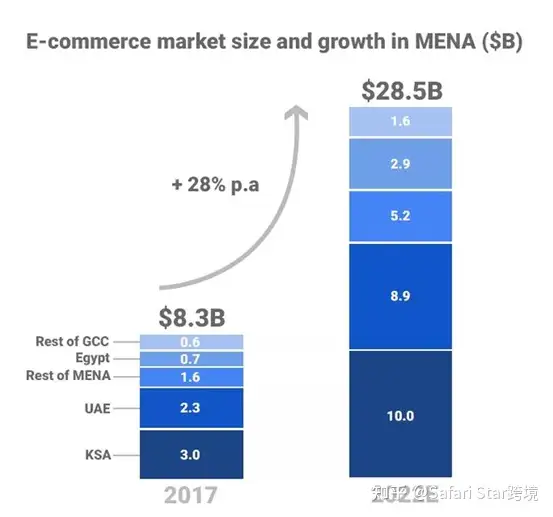

Why is the Middle East market the current blue ocean market for cross-border e-commerce? The tax rate in the Middle East is low, 15% in Saudi Arabia and 5% in the United Arab Emirates. The consumption level is high and the product profit is high. Not only that, 360 million people show that the development space is huge, and the Internet coverage rate of 88% gives more confidence to sellers;

On the other hand, the e-commerce market in the Middle East is developing rapidly and the e-commerce platforms are also very young, with flexible operations and many supporting preferential policies. In addition, there are relatively few e-commerce companies currently settled in, resulting in low competition, which has attracted the attention of many cross-border e-commerce sellers;

Compared with mature European and American markets, the e-commerce market in the Middle East is just starting: according to market reports, the total e-commerce market in 2020 was $415 million and is expected to reach $4.9 billion in 2021. It is evident that this market has great potential.

List a few reasons:

1. Middle Easterners are wealthy and have a high demand for shopping. The United Arab Emirates and Saudi Arabia, due to their developed oil industries, have per capita GDP of up to $40000 and $20000, respectively. Due to the influence of geographical environment, the development of light industry in the Middle East is limited, and there is very little production of consumer goods. The scarcity of products has led to the extreme dependence of Middle Eastern people on imported products, resulting in huge market demand.

2. The geographical environment has promoted the development of e-commerce in the Middle East. With high temperatures and strong winds in the region, shopping can only be done in limited shopping malls. In addition, due to local cultural factors, it is not convenient for women to go shopping. Therefore, e-commerce has become an important channel for shopping.

3. The level of digitalization in the Middle East is constantly increasing, with a high smartphone penetration rate that continues to grow year by year. Take Saudi Arabia as an example, the smartphone penetration rate has reached 96%, laying a solid foundation for the booming development of the e-commerce market.

4. In recent years, governments in the Middle East have sought to support economic development through investment and legislative changes, with good policy benefits. Investing heavily in world-class events such as the 2022 Qatar World Cup. In order to reduce the country's economic dependence on oil, policies such as the Digital Oman Strategy and the Dubai Business City Plan will greatly promote the transformation of economic growth in the Middle East towards a digital economy, providing excellent development opportunities for e-commerce in the region.

As a result, many cross-border sellers have flooded into the blue ocean market of the Middle East, even shouting, "If you don't enter again, it's too late

But to enter the Middle East market, compliance with value-added tax is the biggest risk

Whether it's Amazon's Middle East site or Noon, it's best to register a Middle East VAT number in advance. According to some European cross-border sellers who have entered the Middle East site, compared to the 20% profit margin of European sites, the profit margin of Middle East sites is over 40%!

Such beautiful data has kept many Chinese sellers at the periphery of the market, because there is no platform available for Chinese sellers to "play" locally, especially the Saudi site, which requires Amazon's invitation to open a store.

Attention: Register a VAT number first to successfully enter the Middle East market!

We need to first understand the registration requirements for Middle Eastern VAT numbers:

1, The tax authorities of the United Arab Emirates and Saudi Arabia have different requirements for VAT registration for non local companies compared to local companies

Local companies with annual sales of 37.5W (AED/SAR) are subject to mandatory registration; If the annual sales reach 18.75W (AED/SAR), you can choose to voluntarily register for VAT.

Non local companies (without offices or fixed establishments in the UAE or Saudi Arabia) need to submit a registration application within 30 days of the first order.

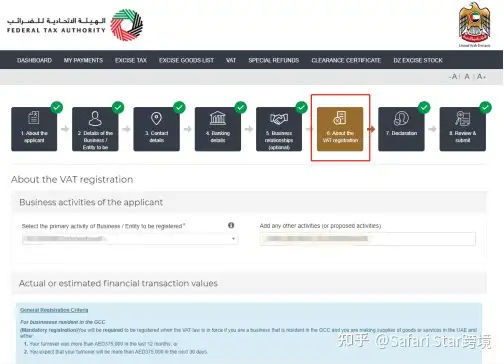

2, Furthermore, it is necessary to understand the materials required for registering Middle East VAT and the duration of the registration application cycle

List of VAT registration documents for UAE and Saudi Arabia:

1. Business License

2. Corporate passport

3. Screenshot of the backend of UAE and Saudi Arabia site stores

4. Registration Application Form

The registration application process takes about 4-6 weeks, depending on the approval of the tax bureau. The registration information needs to be filled out and submitted on the official websites of the UAE and Saudi Arabia tax authorities.

3, Finally, it is necessary to understand the materials required for Middle East value-added tax declaration, declaration methods and cycles, and tax payment methods:

UAE VAT rate: 5%

Saudi Arabia's VAT rate will be increased to 15% from July 1, 2020 (affected by the COVID-19 and the collapse of oil prices)

Required documents for declaration:

1. Sales data report;

2. Bank payment receipts;

3. Input Invoice

Declaration method:

Generally speaking, in the United Arab Emirates, quarterly declarations are required (tax authorities may also specify monthly declarations), similar to the UK where declarations are made in different time periods such as 3-6-9-12, 1-4-7-10, and 2-5-8-11. It is necessary to declare once every quarter (every three months) according to the requirements of the tax authorities;

Generally speaking, Saudi Arabia reports on a quarterly basis, which is 1-4-7-10; Sales reaching 40MM (SAR) need to be converted to monthly declaration. The deadline for declaration in the United Arab Emirates is usually on the 28th of the month of declaration, while in Saudi Arabia it is on the 30th/31st of the month of declaration.

Anyway, registering a VAT number for the Middle East region first is definitely very advantageous. However, due to the high threshold, the competition in the Middle East site is relatively less intense at present. Some sellers who do not want to miss the Middle East market but are not familiar with it, in order to save costs and quickly occupy market share, register their VAT number.

But the delighted sellers do not know that they will face huge risks hidden under the temptation of money next--

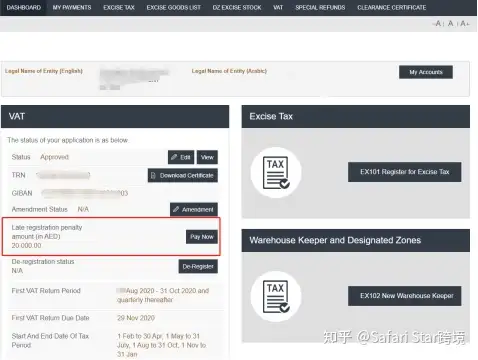

Recently, many sellers who have self registered for UAE VAT have contacted us at Sand Star Cross border, hoping to help them solve their problems. After communication, we learned that the customer referred to the UAE registration guidance on the internet and Amazon store backend, and self registered their tax number. After 1-2 months of waiting, the tax number was finally approved, but at the same time, the late registration penalty was also issued to the customer's account along with the tax number.

Why does this problem occur? You should know that before uploading the tax number, you have received a fine of up to 20000 dirhams, and many sellers are even hesitating whether to continue with this store.

Based on the investigation of Shazhixing's cross-border tax consultants stationed in the Middle East, a conclusion has been drawn:

The main reason for the fines incurred by sellers for self registration is mostly due to incorrect sales proof documents uploaded when filling out the registration form on the official website of the tax bureau.

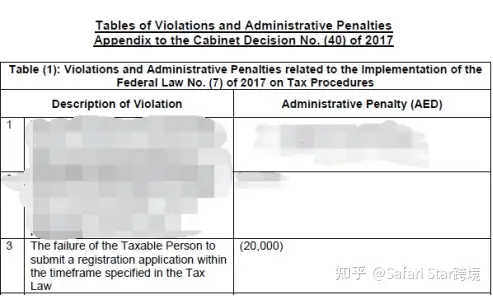

Regarding the penalties imposed by the UAE Tax Authority:

The UAE tax authority requires non local companies (without offices or fixed establishments in the UAE) to submit a registration application within 30 days of the first order, otherwise they may receive a late registration penalty issued by the tax authority. UAE: 20000 (AED).

The late registration penalty and late declaration penalty issued by tax bureau civil servants will be based on the sales start time displayed in the sales documents provided by the seller's friend. The minimum amount of late declaration penalty is 1000 AED. The late registration and late declaration fines issued by the tax bureau can be viewed in the "MY PAYMENT" section of the account.

The UAE tax authority imposes penalties for late declaration and payment:

Late declaration penalty: Failure to declare and pay value-added tax within the prescribed time: AED 1000 for first-time late declaration; Starting from the second occurrence of late declaration, AED 2000 (late declaration penalty) will be imposed each time.

Late payment penalty:

a> Penalty for late payment -2% of tax;

b> Penalty for failure to pay after the 7th day of expiration -4% of the tax;

c> If the payment is still not made after one month of expiration, the daily accumulated tax will be 1%, up to a maximum of 300% of the tax

The correct handling method after receiving a fine notice:

After obtaining the tax number approval, the first step is to log in to the account to view the declaration period and method approved by the tax bureau.

2. According to the requirements of the tax bureau, declare immediately or make up for previous declarations.

3. Important information declared must be carefully reviewed and memorized. Because the late declaration and late payment tax penalties imposed by the UAE tax authorities are also significant.

4. Late registration fines can be appealed to the tax bureau through our cross-border accountant at Shazhixing, and there is a high probability that they can be appealed.